Solar Financing Explained: The Truth About “0%” Solar Loans

If you’re shopping for solar in Alberta, you’ve likely seen ads promoting 0% solar financing.

It sounds like free money.

In reality, most 0% solar loans are structured in a specific way — and understanding that structure is critical if you want to compare quotes fairly and avoid overpaying for the same system.

This article explains how 0% solar financing works, when it can make sense, how Alberta homeowners should compare options, and how Greenamp approaches financing transparently.

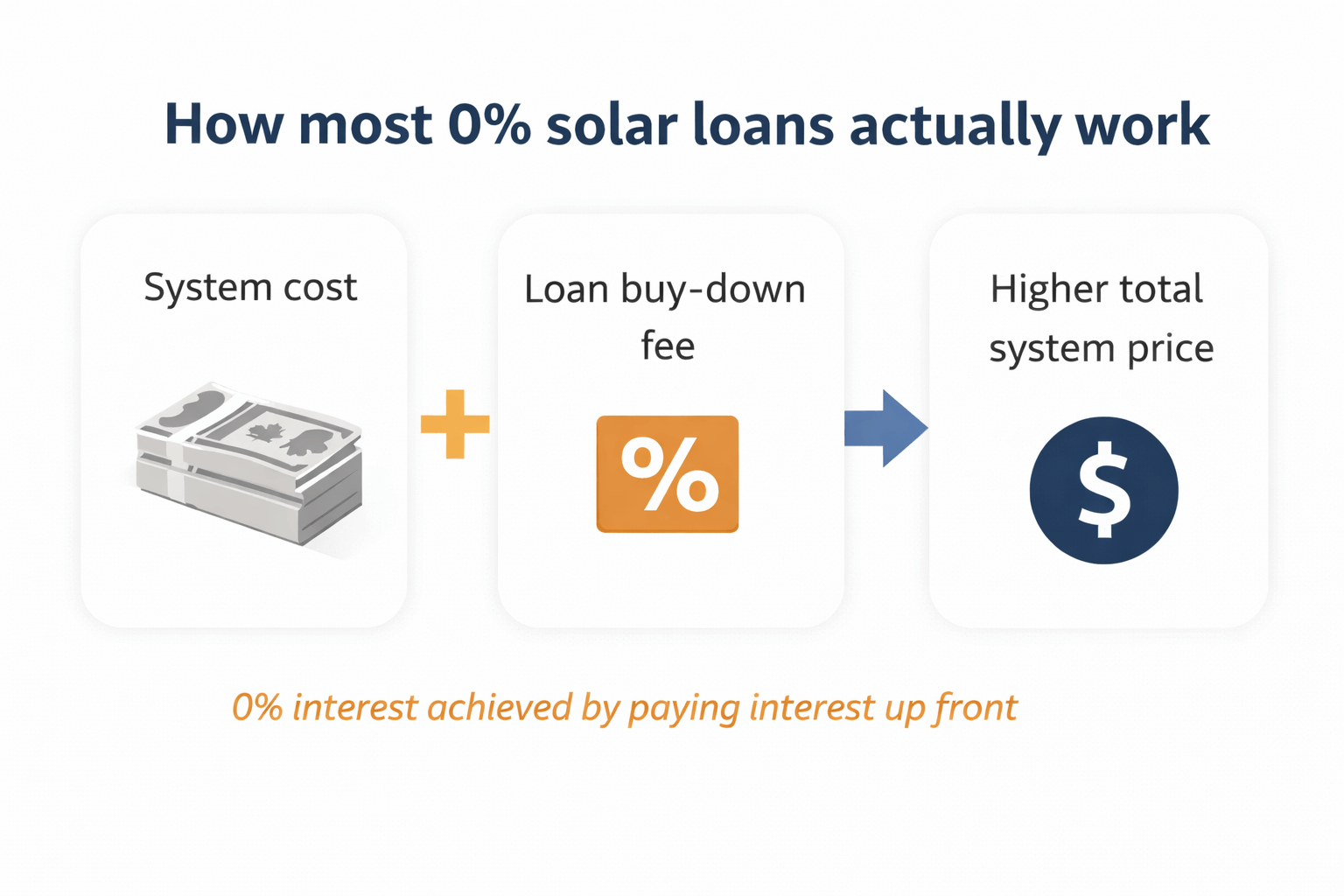

How most “0%” solar loans really work

When a solar company advertises a 0% loan, the lender still needs to earn a return.

Instead of charging interest over time, many lenders charge an upfront loan buy-down (dealer) fee. That fee is used to reduce the interest rate to 0%.

Here’s the part most homeowners never see:

That buy‑down fee is often rolled directly into the system price.

From a financial standpoint, this is similar to paying interest up front — it is simply hidden inside the total project cost.

This structure is one of the main reasons two solar quotes for similar systems can differ by 30–50% or more.

Illustrative example showing how many 0% solar loans are structured, with interest effectively paid upfront through a loan buy-down fee.

Why this matters when comparing solar quotes

Two installers can propose:

The same system size

Similar panels and inverters

Comparable energy production

…and still present dramatically different prices.

Often, the difference is not equipment quality or workmanship.

It is how financing is structured and disclosed.

Monthly payments can look attractive, but the total installed cost is what determines long‑term value.

See how to compare solar installers fairly across Alberta.

Greenamp’s approach to 0% solar financing

At Greenamp, we believe financing should be transparent, flexible, and aligned with long-term value.

From time to time — depending on availability and terms from lender programs — we offer promotional financing options that can include 0% interest for qualified Alberta homeowners.

These promotions are designed to reduce short-term cash pressure during installation and commissioning.

Just as importantly:

We clearly show the cash price of your solar system

We separately disclose the cost of the promotional loan

We explain exactly how the 0% rate is achieved

There is no hidden math.

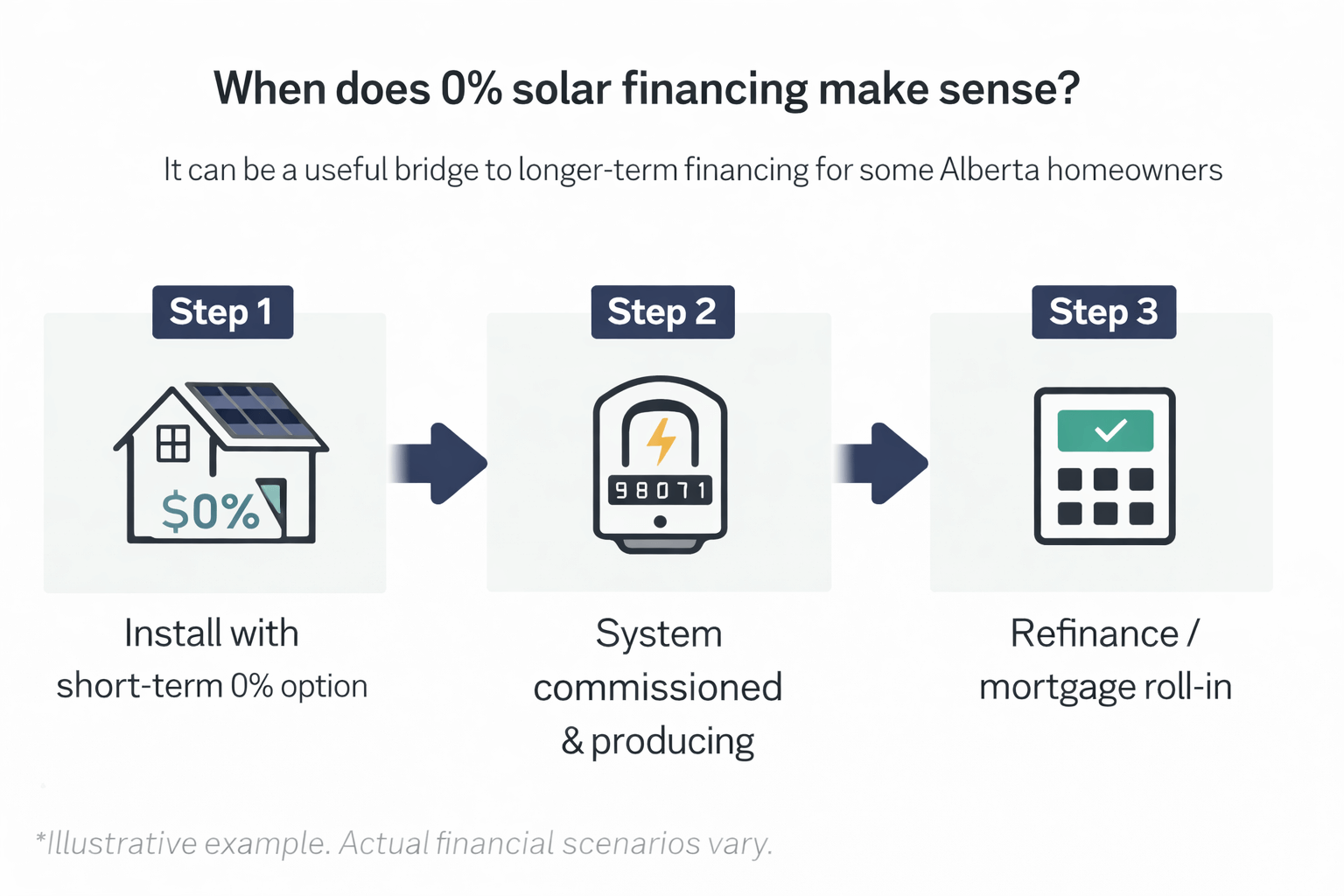

Why we recommend treating 0% financing as a bridge

While promotional 0% financing can be useful, it is rarely the lowest‑cost long‑term option.

For that reason, we proactively recommend that homeowners:

Switch to a lower‑cost financing option after installation, or

Roll the system into their mortgage when it comes due

This approach allows customers to benefit from short‑term flexibility without paying unnecessary long‑term financing costs.

Promotional 0% financing can be useful as a short-term bridge. The long-term goal is to optimize total cost once the system is live.

Is 0% solar financing ever the right choice?

It can be — if the trade‑off is clearly understood.

A 0% loan may make sense when:

Cash flow matters more than total project cost

Payments are delayed during installation

There is a clear plan to refinance later

The problem is not 0% financing itself.

The problem is when it is presented as free without showing the true system cost alongside it.

A simple comparison example

Let’s look at a simplified comparison for illustration:

| Option | Advertised Rate | System Price | Financing Cost | True Cost |

|---|---|---|---|---|

| Promotional 0% loan | 0% | Higher | Embedded | Highest |

| Market-rate loan | 6–7% | Lower | Transparent | Lower |

| Cash | N/A | Lowest | $0 | Lowest |

Same system. Same production. Very different economics.

Built for Alberta homeowners

Greenamp installs solar systems across Alberta — including Calgary, Edmonton, Red Deer, Lethbridge, Medicine Hat, and surrounding communities.

While utility requirements and site conditions vary, the principles of transparent pricing and fair financing apply province‑wide.

The question every homeowner should ask

Before choosing a solar loan, ask:

“What is the cash price of this system, and how much of this total is financing cost?”

Any installer focused on long‑term trust should be comfortable answering that question clearly.

If you’d like help reviewing a solar quote or understanding your financing options, we’re always happy to walk through it with you — calmly, clearly, and without pressure.

Solar is a 25–30 year investment.

You deserve to understand the math.

Frequently Asked Questions (FAQ) About Solar Financing

Is 0% solar financing really free?

No. In most cases, the cost of financing is prepaid through a lender buy-down fee that increases the system price.

Why do some solar systems cost much more when 0% financing is included?

Because the interest is often embedded into the system price rather than charged monthly.

When does 0% solar financing make sense?

It can make sense as a short-term bridge when payments are delayed and there is a clear plan to refinance later.

Can I refinance my solar system after installation?

In many cases, yes. Some homeowners switch to lower-cost loans or roll the system into their mortgage.

Does this apply across Alberta?

Yes. While site conditions vary, financing structures and transparency principles apply province-wide.